As a commercial cleaning business, your service offerings likely include a wide array of duties, which will be carried out by a diverse workforce, across a variety of locations. With so many different circumstances all occurring at once, the potential for errors can be huge. Bigger still, are the significant costs associated with such mistakes.

For this reason, it’s crucial to have cleaning and janitorial general liability insurance in place—no matter how big or small your business. This will cover any legal fees, as well as the compensation costs in a claim involving incidental injury to a client or incidental damage to their property.

Is it Time to Take Cover?

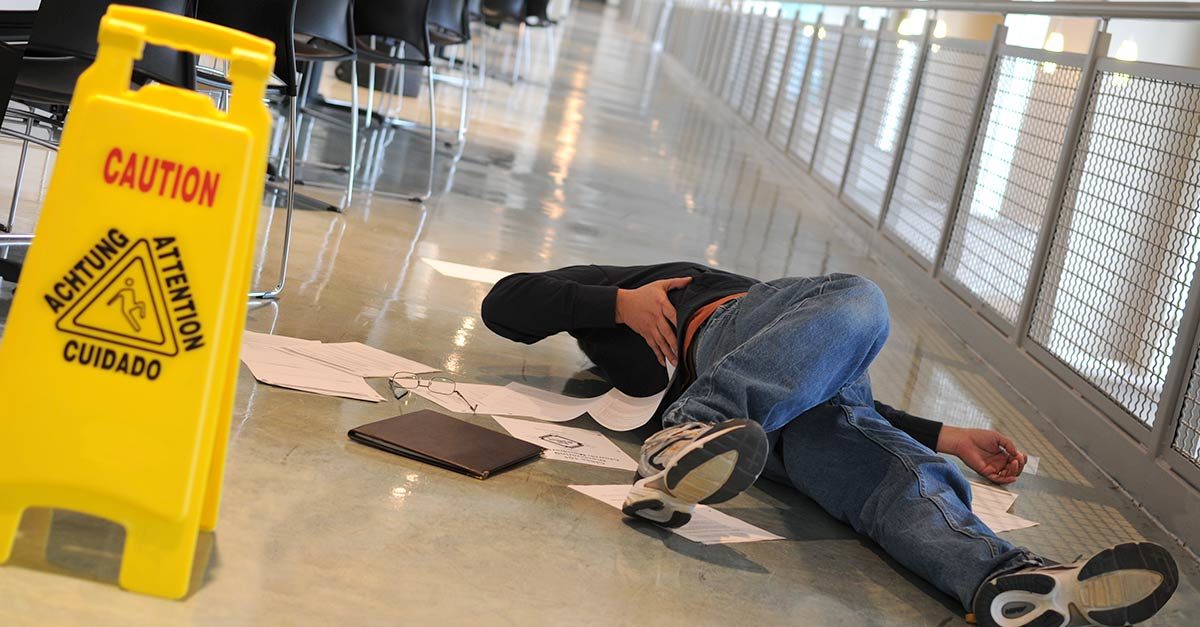

Trips and falls are the most common claims made within the cleaning industry, followed by damage to property, spills and breakages to personal items, and lost keys.

According to the National Floor Safety Institute, the average liability award for injury to a customer or other third party runs from US$60,000 to $100,000 per claim. This situation is made even worse by the individuals making fraudulent claims against businesses, with scams of this nature reported to cost $70 billion annually. Ask yourself if your business could afford to cover these costs without protection from insurance.

Some businesses may only contract to a cleaning company that is covered with a general liability policy. In addition, businesses with this coverage demonstrate a higher level of professionalism to both existing and prospective clients and provide peace of mind if you (or they) slip up somewhere along the way.

As even the most meticulous staff members are not exempt from making mistakes, it’s best to err on the side of caution by protecting your business with a comprehensive general liability policy.

Reduce the Risks

Although protecting yourself with general liability insurance will help cover costs in the event of an accident, it will not protect the business from having accidents. Therefore, it is vital that businesses should take the necessary steps to minimize their risk levels where possible.

The first step to reducing the possibility of a claim is to establish company health and safety policies and review these procedures with staff regularly. In addition, sufficiently train employees to use equipment and be aware of any specific rules or risks associated to their job positions.

Review training frequently and update it each time something changes that may affect their role—no matter how minor the change may seem. A company handbook will ensure employees remain suitably informed of their day-to-day duties and expectations.

Ensuring that accurate documents are maintained at all times also will help to minimize the risk of a claim being made against your business. Make sure a list of your duties, rates, products, and services is clearly outlined in a signed contract. This way, there is a record of responsibility should someone file a claim.

Don’t Get Cleaned Out by a Claim

Without a suitable general liability insurance policy, you could find yourself falling into a lengthy drawn-out battle with a client. Not only is this time-consuming and stressful, but it could also be financially crippling, especially to smaller businesses.

It’s not worth putting your business at risk by not having a general liability insurance policy in place, especially as coverage starts from less than $1.50 per day. Speak with an insurer who will tailor policies to meet your business needs and find the best level of coverage at the best price.