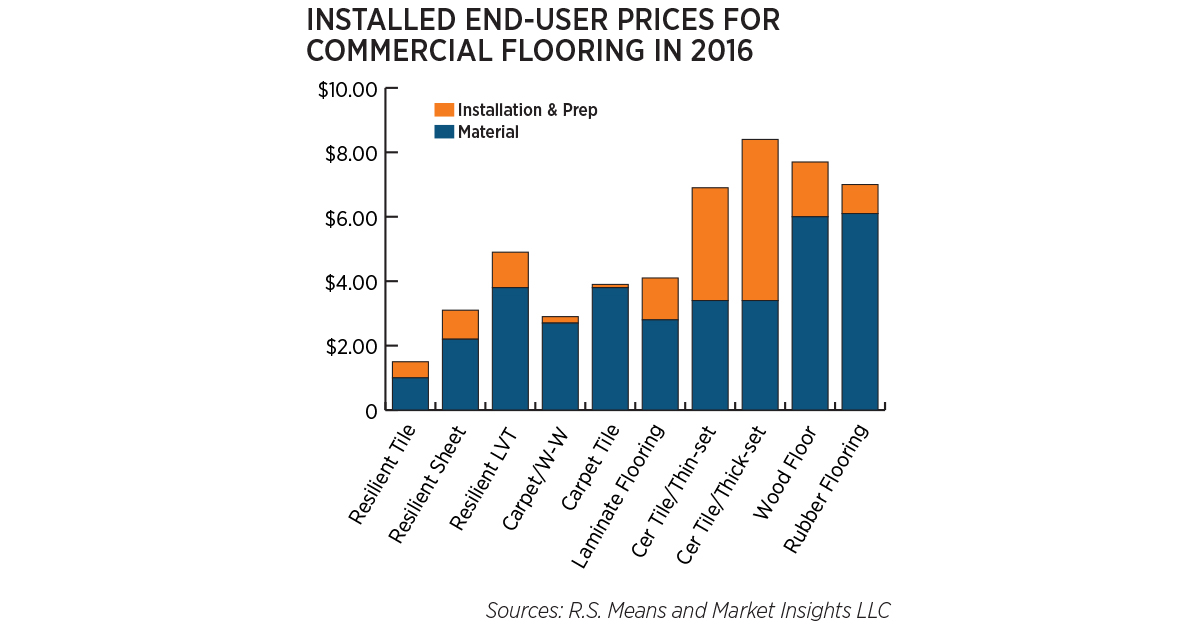

In 2017, the total flooring market for commercial and industrial settings (excluding rubber flooring) was forecast to grow 5.1 percent to US$7.3 billion at manufacturer sale pricing—or 4.8 billion square yards in volume. The average price per square foot was estimated to be $1.39, up from $1.36 in 2016.

This is one of many findings industry professionals can find in the ISSA & American Association of Cleaning Equipment Manufacturers (AACEM) Industry Trends Report. This report was developed to help industry professionals stay current with commercial construction and renovation activity and projections, flooring materials trends, and key U.S. economic indicators. For example:

- Building service contractors can gain greater understanding of end-user trends and preferences to adapt their product offerings and service solutions.

- In-house service professionals may gauge flooring installation trends and analyze how their facilities compare to similar building types.

Following are some additional key findings.

Popular Flooring Types

According to the 2017 third-quarter ISSA & AACEM Industry Trends Report, most flooring types are performing somewhat near to forecast levels. The fastest growing flooring type is resilient flooring, which was up 12.9 percent in the year to date, compared to an 8.4 percent forecast. Conversely, hardwood flooring was the biggest laggard, falling 11 percent in the year to date as luxury vinyl tile (LVT) and other hard surface floorings cannibalized wood flooring sales more than expected.

Floor Type by Building

A key trend in health care is consolidation—as major health systems merge, hospitals acquire physician and specialty practices, and physician groups join forces to reduce overhead. Based on the nature of the health care business, hard surface floorings, resilient flooring, LVT, and ceramic tile are being used for practicality and cost considerations.

Commercial Construction Trends

While nonresidential construction has been volatile during the last several years, the commercial renovation market has grown steadily and overall is forecast to grow slightly during the next few years as more buildings age and require renovation, maintenance, repair, and remodeling.

Facilities

As the 2017 second-quarter report indicates, offices composed 26 percent of already-existing commercial flooring in 2016. Keeping tabs on office vacancy rates on a quarterly basis can prove valuable to those supplying and servicing this market.

Access the full report

The quarterly reports from 2017 are available exclusively to ISSA and AACEM members at www.issa.com/flooringtrends. More information about membership is available at www.issa.com/membership.