When Amazon announced it was raising its minimum wage to US$15 per hour nationwide starting November 2018, “the air went out of the room,” said Marc Collings, senior vice president of sales and marketing for Varsity Facility Solutions. “We all just gasped.”

In an industry where the labor market is tight, competition isn’t just about landing contracts and clients—it’s about finding bodies to get the work done, panelists said during ISSA Show North America 2018’s building service contractor state of the industry panel discussion. However, this becomes more challenging when competitors raise their own minimum wages to well above the market rate. “Cleaning is not the issue,” said Mary Miller, CEO of Jancoa Janitorial Services. It’s finding people—especially janitorial staff—who aren’t going to leave your organization for a better paying job at another.

At the end of the day, Miller says, workers will make a move for extra money, which is why finding loyal team members has “been more of a challenge than ever” in the evolving marketplace, a top concern that was also expressed by building service contractors (BSCs) who took CMM’s 2018 BSC/Contract Cleaning Benchmarking survey.

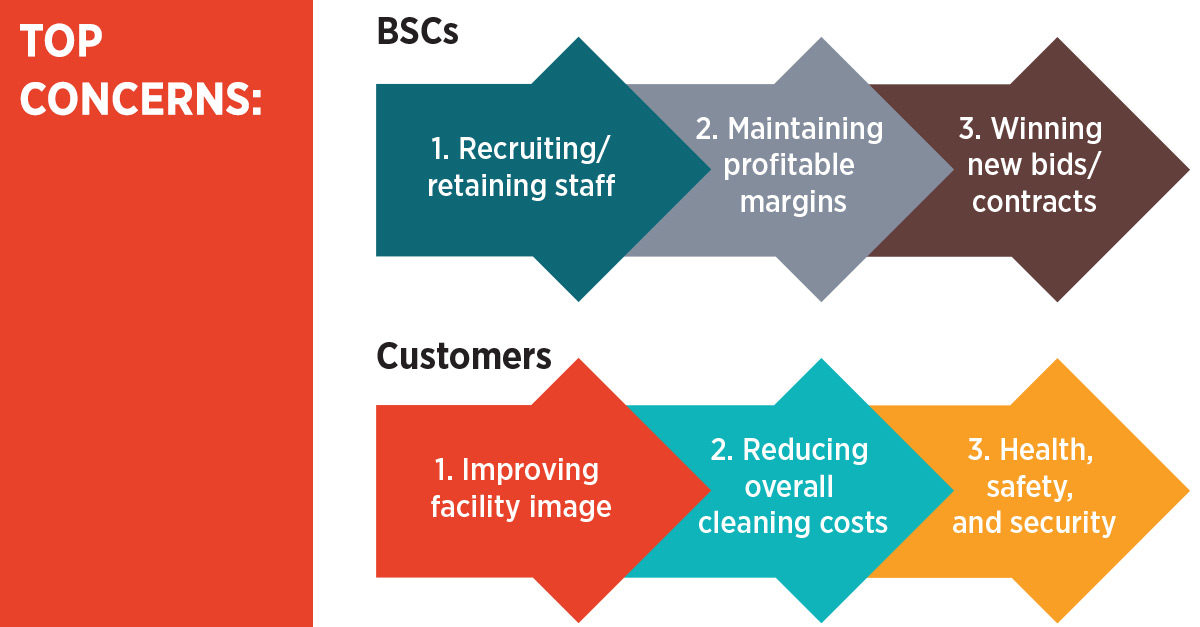

Top Challenges and the Competitive Marketplace

In a transient labor market like the commercial cleaning industry, staff recruitment/retention is the No. 1 issue for building service contractors, according to CMM’s 2018 BSC/Contract Cleaning Benchmarking Survey. About 84 percent of the 278 BSCs who completed the survey said recruiting and retaining staff was a challenge for their organizations to a moderate or large extent.

According to Michael Diamond, president of facility services provider AffinEco, LLC, finding loyal employees is becoming even more challenging as additional pressure to increase wages continues to close in from outside labor markets. “If someone wants to go get a job, and they get [a minimum of $12.75 per hour] working at McDonalds, why would they come [to the cleaning industry?].” In this case, Diamond is referring to the state of New York, where the minimum wage for fast food workers is higher than it is for janitorial services—up to $1.25 more per hour in some areas.

Whether it’s Amazon or the fast food industry giving contract cleaning providers a run for their money, one thing is certain—the wage market is becoming more complex. “You used to just worry about state and federal wages,” Collings said. “Now you have municipalities announcing their own.”

Clients and BSCs Don’t Align

Although staffing and retention are major pain points for BSCs, results from the 2018 BSC/Contract Cleaning Benchmarking Survey show these top stressors may conflict with the top challenges and needs that directly impact their clients. For example, 88 percent of surveyed BSCs said facility image is an issue impacting their customers; 83 percent said reducing cleaning costs is an issue. This raises an interesting question: How can BSCs address their own challenges by remaining competitive in the labor market, while continuing to address their clients’ needs of higher quality for lower prices? Collings said being this adaptable takes a lot of work, cooperation, communication, and also creativity. In other words, finding new ways to “offset those costs.”

Finding Other Ways to Compete

The biggest change Collings has seen across the commercial cleaning landscape during the past decade has been the expectation of the customer. “We have to be more sophisticated as an industry to compete,” he said.

This year’s survey results suggest that some companies are trying to do as Collings suggests and adapt. Some are choosing to diversify services (12 percent increased revenues last year doing so); some are exploring new technologies, such as interconnected devices (49 percent) and antimicrobial surfaces (43 percent); and some are exploring new vertical markets to lock in new business.

An Optimistic Outlook

Despite their challenges, 83 percent of surveyed BSCs are expecting revenue growth in 2018. Commercial facilities will be a primary target for new revenue, with 42 percent focusing on buildings that house offices and businesses. However, even with an optimistic outlook, it’s impossible to know for certain what the upcoming year will bring.